reit dividend tax canada

15 on the first 50197 of taxable income 205 on the next 50195 of taxable income on the portion of taxable income over 50197 up to 100392 26 on the next 55233 of taxable income on the portion of taxable income over 100392 up to 155625. 23 rows The Canadian government requires that REITs withhold 15 of shareholder distributions defined as return on capital.

I Did All The Due Diligence For Canadian Reits Based On Their Q2 Reports Take A Look At This Table R Canadianinvestor

A real estate investment trusts must distribute more than 90 of its earnings each.

. According to the Canada Revenue Agency current federal tax rates by tax bracket are. Currently the maximum long-term capital gains tax rate is 20. For example if you paid a REIT share 10 and the REIT has a ROC of 050 per share your new cost is 950 per shares.

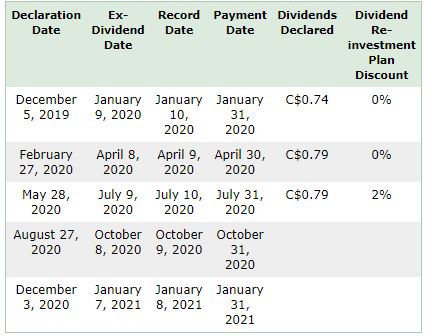

Dividends from REIT companies are generally taxable as ordinary income above the maximum rate of 37 395. The Canadian government imposes a 15 withholding tax on dividends paid to out-of-country investors which can be claimed as a tax credit with the IRS and is waived when Canadian stocks are held in US retirement accounts. Again you can view the tax breakdown of CREITs distribution on its website.

The 293 billion REIT is the lone real estate stock in the cure sector. Sort the REITs based on the Chowder Score Yield and Dividend Growth Sort the REITs by Dividend Increases Consistency in dividend increases is good Narrow Down Your Canadian REITs I decided to eliminate the little players. Over the long term paying that 025 expense ratio is going to eat into your returns.

At least 75 of the total fair market value of all trust properties that the REIT holds must be in Canada. In 2026 the budget will rise to 6 with an additional 3. When a shareholder receives a dividend they have to declare the dividend on their income tax return.

All Canadian banks pay quarterly dividends but the fund is paying out a monthly dividend. It owns and operates a portfolio of healthcare real estate infrastructure such as. 710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the.

When you go to sell appreciated REIT shares however this growth will be subject to capital gains taxes. 35 rows To find the best Canadian REITs fitting my criteria I choose to go through the following steps. The REIT collects rental income pays its expenses and then distributes almost all its remaining incomeusually 85 to 95to unit.

The Canada Revenue Agency applies a 150198 tax on the tax portion of eligible dividends and a 9031 rate on the tax portion of non-eligible dividends. Capital gains are taxed at a rate of 50 in Canada and the investor must include this in their taxable income. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income.

So you would claim 506 as dividend income on your return. The best tax rate on a Qualified REIT Dividend normally takes into account the 20 deduction. Second your REIT can also provide you with income in the form of share growth.

When calculated by taking into account the 20 deduction a Qualified REIT Dividend usually pays the highest tax rate of 290. Real estate investment trusts REITs are one of the most popular options for investors seeking regular income. The marginal tax rate for qualifying dividends is only 2.

The rate shareholders will pay depends on how long they owned the REIT and their marginal tax rate. When they flow their income through to their unitholders the REITs dont pay much if any corporate tax. REITs pay dividends up to 37 taxed at 38 so they tend to pay more as ordinary income.

Taxpayers may also generally deduct 20 of the combined qualified business income amount which includes Qualified REIT Dividends through Dec. The tax withholding applies to REITs held in tax-sheltered as well as regular accounts. Of this 120 of the dividend comes from.

Then Taxable amount of the other than eligible dividends 200 X 115 230 Total taxable amount 276 230 506 You will report the total taxable dividends on line 12000 of your income tax return. Taxable amount of the eligible dividends 200 X 138 276. In 2011 CREIT paid 143 in distributions of which 7904 per cent was classified as other taxable income 464 per.

This is the reason why I dont hold REITs in a non-registered account. In 2026 the deficit will increase to 6 with a separate 3 increase. More about REITs Canada Canada offers special tax treatment for Canadian income trusts.

However it comes at a cost. The REIT generates 2 per unit from operations and distributes 90 or 180 to unitholders. Best 5-Year Variable Mortgage Rates in Canada nesto 180 Get This Rate Butler Mortgage 184 Get This Rate CIBC 259 BMO 265 Promotional Rate RBC 270 TD 270 Get This Rate Fixed Rate Variable Rate Check Canada Mortgage Rates From 40 Lenders REITs allow you to invest in real estate without the hassle of owning a home.

Citizens may claim a foreign tax credit up to 300 for single tax payers and 800 for married couples filing jointly. Dividends are taxes at the federal and provincial levels. For investors that are interested in REITs for their more traditional forte dividends True North Commercial REIT TSXTNTUN is.

Investment income is taxed at 8. Capital gains taxes are very similar to those incurred when buying United States-domiciled stocks. Even though only half of the capital gains are included in taxable income the capital gains marginal tax rate is 1250 percent or half of the regular income marginal tax rate.

8 hours agoA commercial REIT for dividends. So investors that are just learning how to invest naturally gravitate to the ETF for its monthly dividend. In addition to the investment tax there is an 8 surtax.

An investor buys a REIT currently trading at 20 per unit. 65 tax rate if shareholder owns more than 50 of the REITs shares for the 12 months before the dividend is declared. As you can see in the RioCan distribution above the ROC ratio of a distribution can be significant.

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Reit Taxation A Canadian Guide

Tfsa Investors This 6 5 Dividend Stock Pays You Every Month

Canadian Reits Vs U S Reits Which Are Better Buys For Canadians The Motley Fool Canada

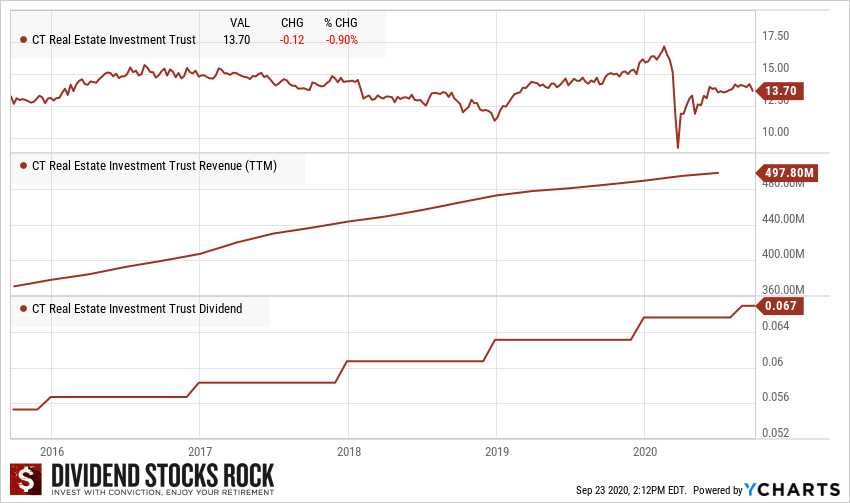

Top 3 Canadian Reits For 2020 And Why Riocan Is Not Part Of It Seeking Alpha

8 Best Monthly Dividend Etfs In Canada 2022 Earn Passive Income

Pin On Dividend Investing Ideas

Reits Canada Still Offers Tax Advantages For These Investments

Dividends A Canadian Dividend Investor S Dream Tawcan

24 Best Canadian Reit Stocks 2022 Invest In Real Estate

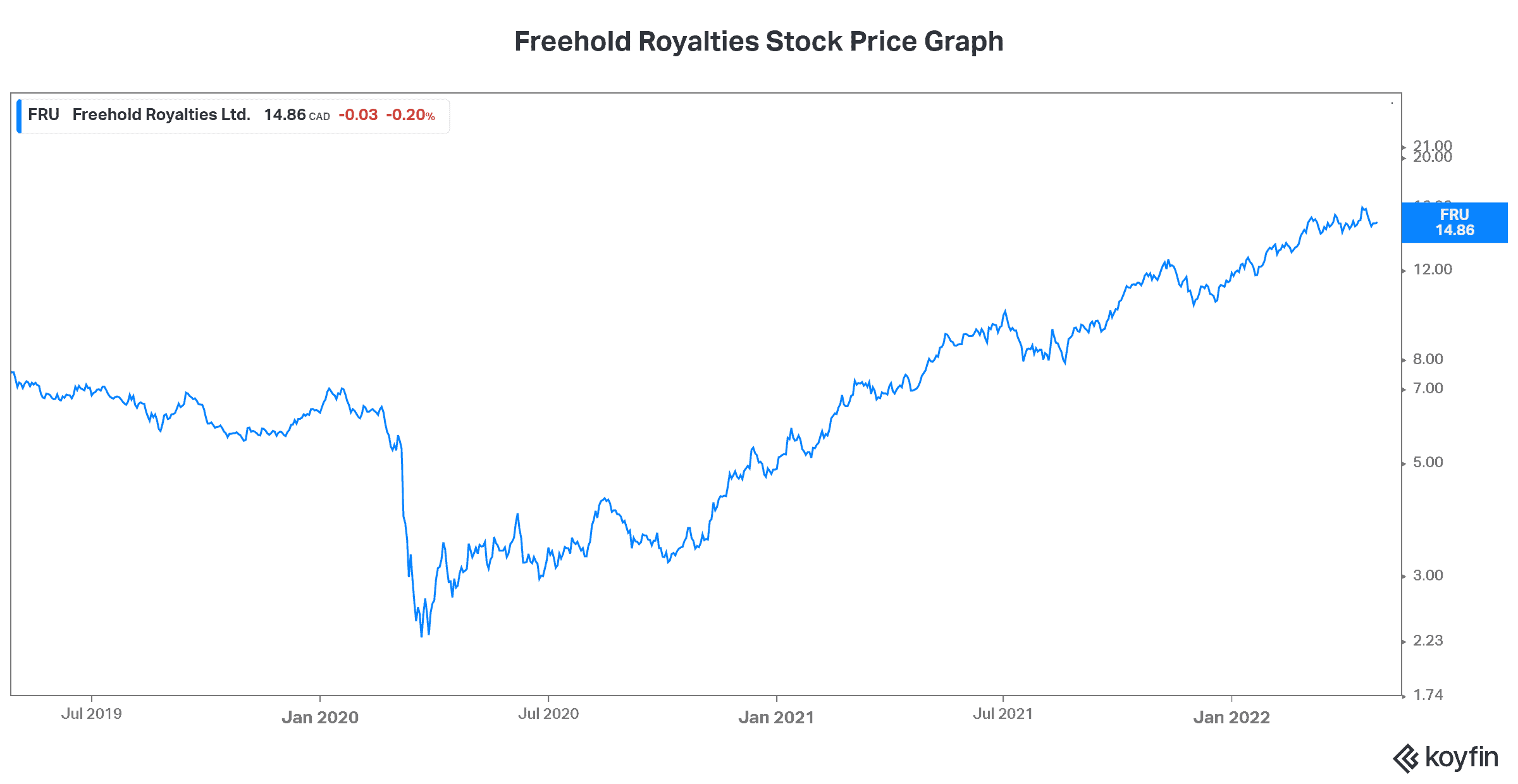

3 High Yield Dividend Stocks To Fight Inflation The Motley Fool Canada

Taxtips Ca Canadian Dividends No Tax

Tfsa 101 You Can Earn An Extra 775 Per Month In Tax Free Retirement Income With This Stock The Motley Fool Dividend Stocks Dividend

Reit Taxation A Canadian Guide

The 20 Best Dividend Stocks In Canada For 2022 And What To Look For When Dividend Investing Hardbacon

Home Business Tax Expenses Small Home Based Business Tax Deductions Each Home Occupation Permit Henderson Dividend Stocks Dividend Investing Finance Investing

13 Best Monthly Dividend Stocks In Canada For Passive Income 2022

Reits Explained For Canadians Real Estate Investing For Beginners Passive Income Investing Youtube